A SHILLING SAVED, A DREAM REALIZED: BUILDING A HOPEFUL FUTURE THROUGH VILLAGE SAVINGS AND LOANING ASSOCIATION (VSLA)

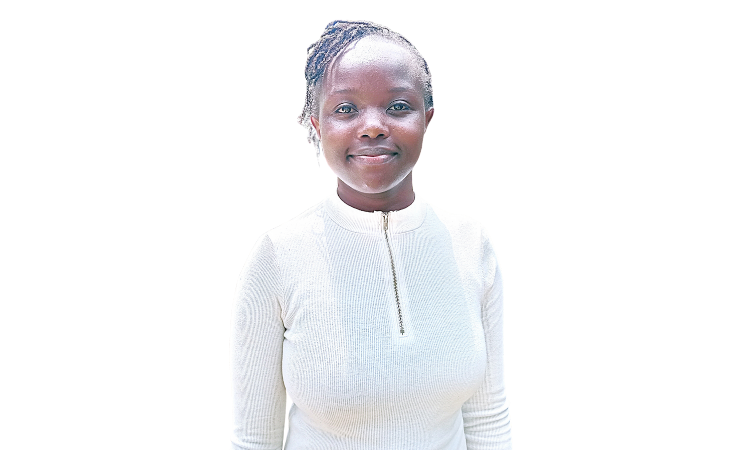

Miriam at her Grocery Shop that she started after joining Miangeni VSLA Group

In Miangeni Village, Kiu Sub-location, Makindu, lives 30-year-old Miriam Mutua, a determined farmer and mother of four; two boys and a set of twin girls, between 8-years and 3-years. Like many in Makueni County, Miriam, a house-wife by then, relied on small-scale farming, but the unpredictable rainfall made it difficult for her to get yield enough to feed her family of Six.

Her turning point came in May 2024, when she attended a Fadhili Trust mobilization meeting in her area. The discussions on financial empowerment and group savings inspired her to take a bold step. Together with other community members, in June 2025, she formed Miangeni Village Savings and Loaning Association (VSLA) group. With guidance from a Fadhili Trust officer, members were trained on savings, lending, establishing and managing small businesses.

Miriam took her first loan of Kshs. 3,000, which she used to start a roadside grocery stall. The stall gained rapid popularity among locals, increasing her sales and allowing her to repay her loan within four weeks. Encouraged by her success, she later borrowed Kshs. 8,000 to assist her expand her business.

“Before joining the VSLA, I often struggled to provide for my family and had nowhere to turn to when I needed money except my already overwhelmed husband. Through the group, I’ve learned how to save and access small loans to grow my business. The trainings have opened my eyes, I now know how to plan, budget, and make wise financial decisions,” says the bubbly Miriam.

At the time, Miriam had also taken in her late sister’s son and was struggling to pay school fees. The growing profits from her business made it possible to support all the children’s education and meet her household needs comfortably.

In June 2025, when Miangeni VSLA group completed its first savings cycle, Miriam received a share-out of Ksh. 12,000, a clear reward for her discipline and hard work. She now plans to use the share-out to build a permanent shop to expand and diversify her grocery stall into a larger and more profitable business.

Miriam interrupts, “The support from other women keeps me going; we encourage one another like family. Even when the rains fail or business is slow, our savings help us stay strong. I’ve managed to pay school fees, expand my vegetable stall, and even take part in community training sessions that have improved my farming skills.”

Miriam joyfully credits God and the Fadhili Trust program for opening a new chapter in her life. Her journey from uncertainty to self-reliance demonstrates how community savings groups can transform livelihoods and empower families toward a more secure future. All these has been made possible by support from our partners Canadian Food Grains Bank (CFGB) and Tearfund Canada under Climate Smart Food Security Project.

“Most importantly, I now have a stronger voice in my home and in the group. My husband and I make financial decisions together, and I feel more confident about the future. The VSLA has truly changed how I think, plan, and live my day-to-day life,” adds Miriam as she smiles brightly, radiating contentment and hope of the current and future life.

In Kalungu Village, Kalungu Sub-location in Kibwezi location of Makueni County where water shortage and harsh weather make farming difficult, Margaret Kimote has embraced simple, sustainable solutions to transform her life. For years, she depended on the Kibwezi market for vegetables, making two trips every week and spending nearly KSh 400 per week on transport—a heavy burden, especially with her frail leg.

In Kalungu Village, Kalungu Sub-location in Kibwezi location of Makueni County where water shortage and harsh weather make farming difficult, Margaret Kimote has embraced simple, sustainable solutions to transform her life. For years, she depended on the Kibwezi market for vegetables, making two trips every week and spending nearly KSh 400 per week on transport—a heavy burden, especially with her frail leg.